The Cable Breaks Out

April 21st, 2011

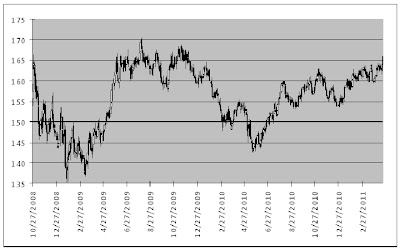

The British Pound Sterling soared higher this morning, building on a three-day rally, and has reached the highest level since the beginning of December 2009. Today’s move, currently up 1.73 to 165.70 basis June futures, was sparked in part by a broadly weaker USD, as well as Retail Sales that beat analysts expectations across the board (see chart)

British Pound Futures

Courtesy of Bloomberg

Economic Slump

The UK

Inflation, which was released a week later on the 12th, did come in below expectations, but still rather high nonetheless. Year over year, headline CPI rose 4%, and Core CPI rose 3.2%. The Bank of England has only one mandate, stable prices, but raising rates to tame inflation doesn’t seem to sit well with the Monetary Policy Committee who voted 6-3 in favour of leaving rates unchanged. The ensuing statement said, “An increase in [the] bank rate in current circumstances could adversely affect consumer confidence, leading to an exaggerated impact on spending”, as well as citing a “significant risk” that inflation could rise above 5%.

The picture got no rosier last week, with Jobless Claims rising unexpectedly, up 0.7K when analysts were looking for a 3.0K decline, on the heels of a sizeable 8.5K decline the month earlier.

On Deck

All eyes will be on the quarterly GDP number to be released on the 27th, which will likely solidify analysts expectations for the Bank of England’s action at next month’s MPC meeting on May 5th. A survey of expectations shows that a small majority of analysts expect a hike in the second quarter.

No comments:

Post a Comment