Grain Outlook

Tuesday, March 22nd 2011

Dwindling Supplies

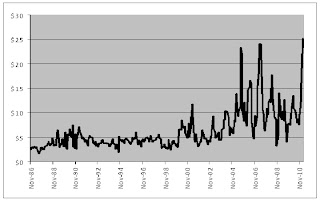

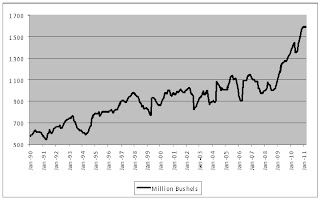

Tight supply and demand fundamentals have underpinned this year’s steadily rising prices, with ending stocks for both corn and soybeans projected at the low end of the historical range. The March 10th WASDE report from the USDA pegged ending stocks for corn at 675 million bushels, and soybean stocks at 140 million bushels. The charts below show the USDA ending stock estimates going back to 1990.

Based on the USDA’s estimate of total consumption, this will leave the U.S. with only 17 days supply of corn, and a mere 15 days supply of soybeans. As the summer progresses, we can expect this to keep old-crop futures well bid. It could also pressure old/new-crop spreads to widen. Since mid-January, the spread between near month futures and November beans has fallen dramatically, and are now close to historical norms. Corn spreads have also narrowed since the beginning of the month, though they remain quite wide.

USDA ending stocks - Corn

Courtesy of Bloomberg

USDA ending stocks – Soybeans

Courtesy of Bloomberg

Export Demand

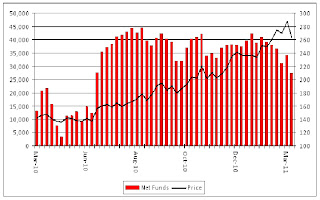

The pace of soybean exports has been rising rapidly in recent years, driven largely by voracious demand from China. Total U.S. exports have nearly doubled in the past few years, reaching a new all-time high in 2010/11, and now represent about 47 percent of total production. Below is a chart of U.S. soybean exports since 1990.

USDA total exports – Soybeans

Courtesy of Bloomberg

Alternative Fuels

Ethanol producers continue to demand even greater quantities of corn, this year setting a new record at 4.950 billion bushels of corn. This amount represents over 36 percent of total corn use, and nearly 40 percent of current U.S. production. Increased demand from ethanol is outpacing production gains significantly. The chart below shows the percentage of U.S. corn production that is used to make ethanol since the USDA began reporting in 2004.

Total corn demand for ethanol as % of total production

Courtesy of Bloomberg

Usage is unlikely to decline in the near term due to the improving economics of blending ethanol, as the price of gasoline has increased at a much faster pace than the alternative fuel. Add to that the $0.45/gallon Volumetric Ethanol Tax Credit available to blenders, and the EPA’s recent approval of E15 (15% ethanol mixed with gasoline) for use in newer cars, and the outlook for continued strong demand looks good.

On the other-hand, production of biodiesel made from soybean oil has been steadily declining since its peak of 691 million gallons in 2008, and has been more than halved to 315 million gallons in 2010, according to the NBB (National Biodiesel Board).

Planting Intentions

While traders are certainly waiting for the March 31st Prospective Plantings reports to set the tone for spring markets, last month’s USDA Annual Outlook Forum gave an early indication of what to expect. Joe Glauber, the USDA’s chief economist told the audience to anticipate 225 million acres to be dedicated to major field crops, a 9.8 percent increase from last year, and the highest since 1998. Of those acres, he expects 92 million to be planted with corn (an increase of 3.8 million acres), and 78 million to be planted with soybeans. Assuming that 84.9 million acres are harvested, and a trend yield of 161.7 bushels per acre, this points to a record corn crop of 13.73 billion bushels.

One reason for the large increase in anticipated planted acreage is the expectation for significant double cropping in the Corn Belt, where winter wheat planting was up 47%. Double cropping entails planting soybeans in freshly harvested wheat fields, which are generally harvested a bit early to ensure that the soybeans are planted in time since crops sown after early July suffer from greatly diminished yields. Glauber estimates that between 5 and 6 million acres will be double cropped this season.

Some private forecasts are less optimistic about soybean acreage. A recent survey conducted by Allendale Inc. indicated farmers were planning to sow 92.291 million acres of corn, and 77.193 million acres of soybeans. Informa Economics Inc. released their updated planting forecast on Friday, in which they raised their outlook for corn plantings from 90.903 million acres in January to 91.758 million acres. For soybeans, they reduced their outlook to 75.269 million acres from 76.654 million in January, well below the USDA’s estimate.

Beans vs. Corn

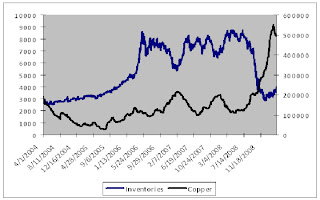

For the past several months the soybean to corn price ratio has favoured corn planting, trading as low as 2.16:1 earlier this month (the old crop ratio got as low as 1.87:1 at the beginning of March). The past few weeks, however, have seen the ratio return closer to equilibrium at around 2.25:1. While optimal ratios of soybeans to corn vary depending on the region, the general rule of thumb is soybeans should cost 2.4 times as much as corn to reflect differences is expected yields and production costs. Below is a chart showing the ratio of new crop beans to corn since 2005.

Soybeans/Corn price ratio

Courtesy of Bloomberg

Back in 2007 and 2008, when the ratio was below 2:1, corn production was increased substantially at the expense of soybeans.

In the aftermath of the devastating earthquake/tsunami/nuclear events in Japan, grain traders have been asking, how will this affect markets?

Japan in the biggest foreign market for U.S. corn, importing nearly 600 million bushels last year to be processed into livestock feed. Initial reports suggest as much as 20 percent of the nation’s feed production could have been affected by the tsunami, which could reduce demand in the short term. In addition, 2 of the 12 major ports that handle grain shipments have been damaged, which may delay imports over the next month or so while repairs are made, though Japan’s ports are expected to be back in full operation within a few weeks. In all, expect only a short term disruption to export demand from Japan, with delayed shipments but no significant cancellations.

It is not yet clear how pronounced the effect of the nuclear situation will be on future grain production in Japan, in particular, how much cropland will be lost due to radioactive contamination. At the moment, it appears that only an area within a 10-mile radius of the plant has been contaminated, but only time will tell.

The 2 primary contaminants released by the fuel rods are Iodine 131 and Cesium 137. The iodine has a very short half-life of only 8 days, so it does not have any long term implications; however cesium 137 has a half-life of 30 years, meaning the radioactivity decreases by half every 30 years. Cesium is absorbed into the soil, so needless to say, if there is widespread contamination it could take hundreds of years for the effects to completely dissipate. Farmer can reclaim lost cropland by removing the top 10cm of soil, depending on how severe the contamination.

-Jaime Macrae, CIM

Account Executive, Friedberg Mercantile Group

jmacrae@friedberg.ca