April 29th, 2011

The USD against Other Currencies

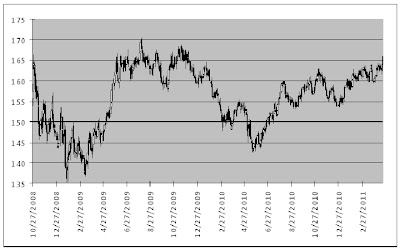

The U.S. dollar has been falling precipitously against virtually every major currency around the world. Sentiment is reaching extremely low levels, and based on the CFTC’s Commitment of Traders report, speculators are short of the greenback in every major pair, with the exception of the Japanese yen. Below is a chart of the net USD position of large non-commercial traders (typically interpreted to represent the positions of large hedge funds and trading desks), overlaid against the U.S. Dollar Index.

U.S. Dollar Index and Net Large Speculative Positions

Courtesy of Bloomberg

During this week’s post FOMC press conference, the first of its kind, Fed Chairman Ben Bernanke was asked about the Fed’s stance on falling U.S. dollar. He was very clear that the Fed believes that a strong dollar is in the nation’s best interest. If he believed what he was saying, it seems no one else did, as the U.S. dollar proceeded to make new lows.

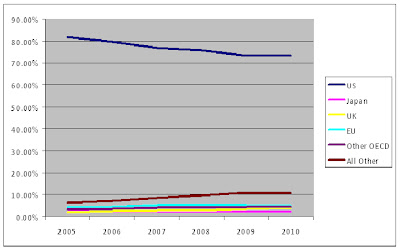

The U.S. Dollar against Non-Fiat Stores of Value

It is always important to remember that when we look at currency values, it is always relative to another currency, but how are fiat currencies doing in general when measured against some other tangible store of value. The obvious example are the precious metals, and more specifically gold. Gold has been rising steadily, making new all-time highs on 14 days in April. Some might argue that gold is not money, but tell that to Utah

Gold in USD and Aussie

Courtesy of Bloomberg

Inflation

If you were to listen to Bernanke, the only thing pushing inflation higher is the rising gasoline price at the pump, which is the result not of a weakening U.S. dollar and overly accommodative monetary policy, but outside geo-political events in the Middle East and North Africa . Let’s turn instead to reality. Over the past 12 months, virtually every commodity has seen significant gains, with few exceptions. The prices of raw material are highly sensitive to excess money creation, and are a fantastic leading indicator of current and future inflation. This is not “transitory” as some would like us to believe.

To the Point: U.S.

Given that the U.S. dollar is in decline, and inflation is on the rise, why are investors willing to lend money to the U.S.

-Jaime Macrae, CIM

Account Executive, Friedberg Mercantile Group

jmacrae@friedberg.ca