High Prices Spur Coffee Sales

March 28th, 2011

Worst Performer

Coffee has been the weakest of the commodity markets over the past week, bucking a long-term uptrend while the rest of the commodity complex showed broad strength. Coffee prices have been steadily rising since the beginning of 2010, as demand rebounded from a slight decline in 2009, and the supply side of the balance sheet recovered from the biggest deficit since at least 1980. The market also benefited from a steadily depreciating U.S. dollar over the same timeframe. World coffee ending stocks in terms of usage remain near historical lows, sitting at just under 25 percent at the end of 2010. The last time coffee prices reached these levels was back in 1997, when prices reached a high of $3.18 per pound, while the global supply of coffee remained in a deficit for a 5-year stretch from 1995 to 1999. The fact that coffee prices have shown such weakness in the face of broad-based commodity strength is likely a reflection of exporters bringing supply to the market to take advantage of such historically high prices.

Backwardation and Exports

Over the past month, the forward curve for London-traded robusta coffee futures has shifted from a slight contango (the ‘normal’ state of the market, where deferred months trade at a premium to spot, reflecting storage and insurance costs), to a steep backwardation between the May and July contracts. When a market is in backwardation is means that near month contracts trade at a higher price than those further along the forward curve, and usually indicates that there is a short term supply crunch (see chart).

LIFFE Robusta Forward Curve

Courtesy of Bloomberg

The premium available on coffee for immediate delivery has attracted sellers to the market, with first-quarter exports from Vietnam

Robusta vs. Arabica

The rising price of high-quality arabica beans has outpaced the gains of robusta beans, spurring some roasters to push the limits of robusta inclusion in their blends. The ratio of arabica to robusta, typically about 1.95:1 has been on the rise for months, peaking towards the end of December 2010, but still on the high end at around 2.30:1 (See chart).

Arabica : Robusta

Courtesy of Bloomberg

Speculative Position

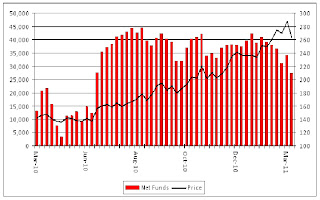

Large speculative traders have held a sizeable long position in the ICE arabica coffee contract since last summer, and are have been liquidating the position since the beginning of the year, indicating that sentiment may be turning (see chart).

Large Speculative Traders

Courtesy of Bloomberg

The sky-high price of coffee is also making its way into the mainstream media (sometimes viewed as an indication of a market top), and several large retail brands have recently announced price increases, including Folgers, Dunkin’ Donuts, Kraft Foods Inc., and Green Mountain.

Technical Outlook

Taking a look at the price in New York

ICE Arabica Coffee Price

Courtesy of Bloomberg

-Jaime Macrae, CIM

Account Executive, Friedberg Mercantile Group

jmacrae@friedberg.ca

No comments:

Post a Comment