Copper

Wednesday, March 23rd 2011

Misleading Headlines

Copper is the top performing commodity of today’s session thus far; however the catalyst for the rally is somewhat suspect. Aside from a couple of high profile supply and demand estimates (more on this below); the big headline was a 45% increase in cancelled warrants at the LME. Market commentators made much of the fact that this was the biggest increase since April 21st of last year. Let us be clear, it was the biggest increase in percentage terms only. In absolute terms, the increase was only 4800 tonnes, which is not an uncommon number (there were two days in February that saw a jump of greater than 4000 tonnes), and is only the highest reading since January 10th of this year.

For those of you who aren’t professional base metal traders, you may be asking, “What are cancelled warrants, and what do these changes mean to the market?” Allow me to explain. An LME warrant is a document of title, representing a quantity of metal that conforms to LME delivery specifications, held within an approved LME warehouse, and most importantly it is tradable. Once an LME warrant is cancelled, the metal is supposed to be earmarked for delivery, even though it may remain in the warehouse. By comparison, LME warehouse stock numbers include all metal in storage, whether it is available to be traded or not. Many base metal traders watch the number of cancelled warrants as an indication of demand, with rising cancellations construed to mean greater demand (and therefore higher prices).

Now, back to today’s rally. Let’s put the increase into perspective. Below is a chart of LME cancelled warrants as a percentage of total inventories.

Cancelled warrants as % of total LME inventory

Courtesy of Bloomberg

The chart clearly shows that despite the attractive headline increase of 45%, this is not really that big of a change, and in fact cancelled warrants represent a much smaller percentage of total inventories than they did last year when the price was much lower.

There are a couple of other points to consider. First of all, in regards to the cancelled warrants, there is the possibility that someone might cancel warrants (remember that this means they tell an exchange clerk that the metal is no longer available even though it can remain in the warehouse) even though the metal has not been sold, and then leave it in the warehouse or move it to another storage facility. A trader might do this to create the appearance of demand, in the hopes of pushing the price up. In the case of the current copper market, the risk of such manipulation is even greater as the March 21st LME report revealed that a single participant controls between 50 and 79 percent of the exchange’s warrants!

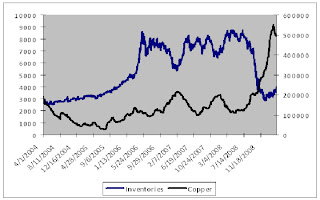

It is also interesting to note that traditional relationship between inventories and price has broken down in recent times. Below is a chart showing the price of copper and LME inventories between 2004 and 2008. As you can see there was a strong negative correlation.

LME copper inventories vs. price

Courtesy of Bloomberg

More recently however, the price of copper continues to march forward despite rising inventories. The chart below shows global exchange inventories (LME, Shanghai

Global exchange copper inventories vs. Comex copper

Courtesy of Bloomberg

Supply and Demand Imbalance

Also adding to today’s strength were two reports indicating a growing deficit in the copper market. Barclays Capital said it expects copper demand to outstrip supply by 889,000 tonnes in 2011, and the International Copper Study Group predicted a 435,000 tonne shortfall. These compare to a 305,000 tonne deficit in 2010 and a 175,000 surplus in 2009. Growing demand from China

-Jaime Macrae, CIM

Account Executive, Friedberg Mercantile Group

jmacrae@friedberg.ca

No comments:

Post a Comment