Canadian Dollar

May 12th, 2011

The loonie has drifted lower over the past couple of weeks; this morning trading down to the low end of the channel in which it has been appreciating steadily since last year. Despite the weakness in absolute terms, the Canadian dollar has shown impressive strength over the past week when viewed against a backdrop of rapidly declining commodity prices. Crude oil and the Canadian dollar have a very strong positive correlation, as the fossil fuel is our nation’s largest export, so in the face of a double digit decline in the price of oil it is reassuring to see the currency continue to trend higher. The same is true with regards to the price of gold.

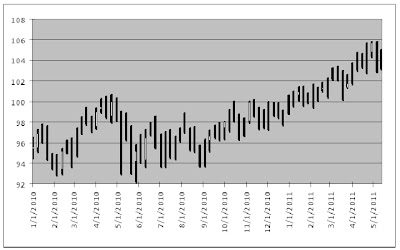

Below is a weekly chart of Canadian dollar futures over the past year. As you can see, the appreciation has been steady and unwavering. When compared to the dramatic rise in other similar currencies, specifically the Australian and New Zealand

Canadian Dollar Futures - Weekly

Courtesy of Bloomberg

The Fundamentals

One of the most important determinants of a currency’s trend is the differential between the interest rates in the two countries. When the interest rate is higher in one country, that nation’s currency tends to strengthen relative to the other. The reason is easy to understand. To illustrate, let’s look back in time to the once ubiquitous ‘yen carry trade’.

Monetary policy in Japan has been extremely accommodative for many years, as the central bank embraced a policy of zero interest rates in an effort to stem persistent deflation, as policy know as ZRIP (zero interest rate policy). Meanwhile, further south in Australia Japan

The Bank of Canada followed the Federal Reserve’s lead and brought the overnight lending rate down to a record low of 25 bps in April of 2009; the Fed had reduced their rate to a band between 0 and 25 bps a few months earlier in response to the financial crisis. By mid 2010 however, the Canadian economy was recovering well, and inflationary pressure pushed the BOC to start raising rates, which they have now done three times, bringing the overnight rate to 1 percent. The Fed is unlikely to raise rates anytime soon, so this is a long term positive for the Canadian dollar that could persist for years into the future.

The Federal Reserve had embarked on a path of money creation on a scale that is unprecedented. Despite rhetoric about the ‘benefits of a strong dollar’, it seems evident to most that there is a concerted effort to devalue the U.S. dollar in order to boost export markets, and inflate their way out of an unsustainable debt situation. Canada

All told, the outlook for the Canadian dollar is very positive.

-Jaime Macrae, CIM

Account Executive, Friedberg Mercantile Group

jmacrae@friedberg.ca

No comments:

Post a Comment