Price Dictates Priorities: Crude Oil Rig Count Surpasses That for Natural Gas

May 20th, 2011

Energy producers in the United States United States

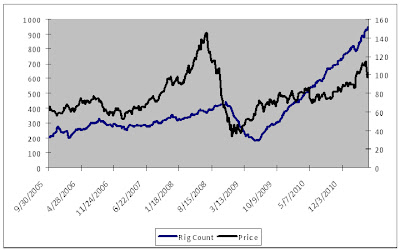

U.S. Crude Rig Count vs. Crude Oil

Courtesy of Bloomberg

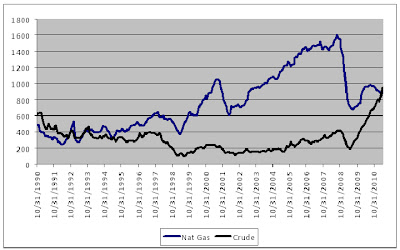

U.S. Natural Gas Rig Count vs. Nat Gas

Courtesy of Bloomberg

The natural gas chart shows that as the price of natural gas fallen over the past three years and found stability in the $4 - $5 range, drilling activity has declined as well. Conversely, the number of rigs drilling for oil has risen rapidly as prices have rallied over the same time period. What makes this particularly interesting this morning is the for the fist time since the early 1990s, more rigs are now drilling for oil than are drilling for natural gas (see chart).

U.S. Rig Count – Nat Gas vs. Crude Oil

Courtesy of Bloomberg

At first glance this would seem to portray a natural gas market that is setting the stage for another major rally, but it is important to realize that with improved drilling techniques producers are yielding more gas from each well, and production has actually increased 7 percent since 2008 when the rig count began to fall.

-Jaime Macrae, CIM

Account Executive, Friedberg Mercantile Group

jmacrae@friedberg.ca

No comments:

Post a Comment